it’s important that i’m transparent as a new solopreneur. while i’m loving each and every moment of this journey, it’s also true that it takes work and motivation. gone is the security of an employer-matched retirement account and a bi-weekly paycheck. you gotta be in charge of your own coins sis.

first, what’s a solopreneur? it’s a business owner without employees and one of the fastest growing types of businesses in the country. check out elaine pofeldt’s the million dollar one-person business to learn more. i often sub-contract with other consultants or contractors, like my part-time project manager, but i don’t have any employees on payroll which sets me apart from other limited-liability corporations.

the possibility of becoming a solopreneur initially scared the shit outta me. i can’t just walk into an HR department anymore to get advice on my insurance plan.

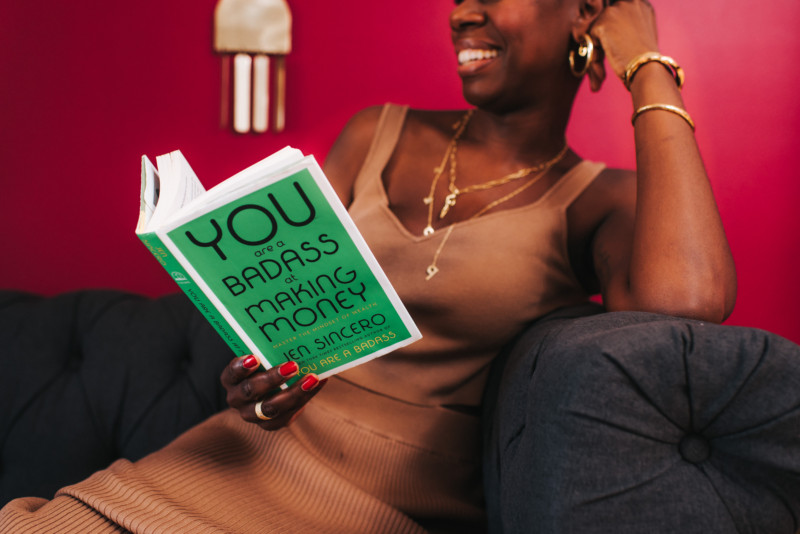

here’s what helped squash my fears: i wrote a list of all the things that terrified me before quitting my job. at the top was managing my finances, which included health insurance and retirement savings. seeing this fear on paper motivated me to develop a plan to address the root causes. i poured myself into books and research on each area below.

while i’m still learning, these tips are helping me to build and grow a successful business.

Health Insurance

being middle class in america is often synonymous with having a “job with benefits.” health insurance is at the top of the list since medical expenses can literally bankrupt folks who are un- or under insured. for this reason, it was pretty damn scary to leave my employer-funded health insurance behind when becoming a solopreneur.

however, thanks to the affordable care act aka obamacare getting health insurance is much easier and affordable than in previous years. before quitting my job, i started researching insurance plans on healthcare.gov. the website has some great resources including this page that summarizes the law.

next, i began to compare plans to determine the best for my health needs. the distinctions between them were super confusing until i found a broker (free of charge) on the aca’s website. she was truly a gift because not only did she do an excellent job breaking down the available plans and recommend which she thought would be best for me as a breast cancer survivor, but she also helped complete the actual application. ultimately, before quitting my job, i was 100% insured with a well-known and reputable insurance provider.

READ: Top Tips for Transitioning Your Side Hustle into Your Main Hustle

let’s talk cost. my monthly premium for health and dental coverage is around $500 for what some might consider a mid to top tier plan. i’m comfortable with this cost since i see specialists multiple times per year, take two prescription drugs daily and will need yearly mammograms for the rest of my life. my insurance is MUCH less than these expenses would be out-of-pocket.

overall, please don’t let the fear of not having health insurance keep you from following your dreams to run your business full-time. i’m no expert, but strongly believe that affordable healthcare plans exist that will meet your needs.

Invoices

invoices can be tricky. i’ve used everything from paypal to free online tools to bill my clients. without a doubt, quickbooks self-employed is the best i’ve found because it connects directly to my business account and allows me to not only send invoices, but also get paid via bank deposit.

quickbooks also estimates my quarterly taxes and develops a profit and loss statement to share with my accountant. as a solopreneur the basic plan, which is about $15 per month, meets all my needs.

here’s a big tip: make a plan early in your business to save at least one month of expenses. as a solopreneur who provides a variety of services to a number of clients, i’m often waiting beyond 30 days for payments. for example, i once waited almost three months for an $8,000 invoice to be processed. the most frustrating part about this wait is a portion of the money was due to my subcontractor.

the delays suck, and unfortunately the bigger the client, the longer it often takes to get paid. in my time as a content creator, i’ve learned that most big businesses take at least 60 days to submit payment. for this reason, i’m learning to spend the money that i have and not the money that i’ve invoiced. when invoices are late, having a cash reserve is helpful to ensure my subcontractors get paid on time and there are no delays with paying for my health insurance and saving for retirement.

Retirement Savings

most experts recommend saving at least 10-15% of your income for retirement. making this investment bi-weekly or monthly through your paycheck is a great way to put your investing on autopilot especially if your employer has a match program. however, what do you do as a solopreneur?

keep investing, duh.

while solopreneurs aren’t eligible for the same types of retirement plans as employees, we can and should invest in a traditional or roth IRA. opening an account with vanguard was one of the first steps i took as a business owner, and i plan to max it out by the end of the year.

i’m also looking to invest in index funds since the IRA max of $6,000 will not equate to the minimum recommended retirement savings for my age. to increase my long-term investing, i plan to use the three fund investing strategy that bola sokunbi suggests in her book on investing.

if you’re planning to start a business PLEASE do not skip out on your retirement savings. investing for your future is non-negotiable.

i hope these three tips for managing your health insurance and finances as a solopreneur were helpful. unfortunately, folks aren’t often transparent about this subject, and it can be hard to find credible information. if you’re a business owner/solopreneur please share your tips down below!

Thank you so much for this information and transparency!!! It was much needed and greatly appreciated.